Recent developments in the heavy-duty commercial vehicle sector indicate mounting headwinds—especially in North America, where new truck orders have fallen sharply, dragging demand for truck tyres. For example, Bridgestone Corporation has publicly stated that truck tyre demand for new vehicles in the U.S. has “plummeted since early August”. The Japan Times+2彭博社+2 For truck-tyre suppliers and fleet operators alike, this represents both a challenge and a strategic opportunity. This article explores current market dynamics, key implications for truck tyre providers, and how our company is positioned to help fleets with value-driven tyre solutions.

he North American heavy-duty truck market is contracting. The Volvo Group has cut its 2025 Class 8 truck forecast for North America to approximately 265,000 units — about 10,000 fewer than previously guided. Reuters Meanwhile, TT News reports that U.S. September Class 8 truck orders dropped 44 % year-on-year, to about 20,800 units. ttnews.com

Correspondingly, tyre demand for new trucks is under pressure. Bridgestone’s CEO stated clearly that “truck tyre demand for new vehicles in the U.S. has fallen sharply since early August”. ttnews.com+1

Nonetheless, the longer-term aftermarket and replacement tyre market still holds promise. One report estimates the global commercial vehicle tyre market (truck and bus radial, TBR) will grow from about USD 20.71 billion in 2025 to USD 33.90 billion in 2032 (CAGR ~7.2 %). Fortune Business Insights

Front-end price is no longer the sole driver. In a climate of soft new-truck demand, fleets are more cautious — opting to evaluate tyres on lifecycle cost rather than just purchase price.

Focus on Total Cost of Ownership (TCO). Operators increasingly emphasise metrics like cost per kilometre, downtime risk, fuel-efficiency differentials, and replacement frequency. A high-quality tyre that lasts longer and reduces incidents can outperform a low-cost tyre in overall economics.

Service and support matter more. Installation quality, ongoing monitoring, rotation/retread programs, and emergency replacement capability are becoming important differentiators for tyre suppliers.

Operational scenario specificity. Long-haul highway, heavy construction, regional delivery, urban stop-go all present different tyre demands. Suppliers who offer matching solutions, rather than generic one-size tyres, gain competitive edge

In this evolving environment, we position ourselves to help fleets succeed by offering:

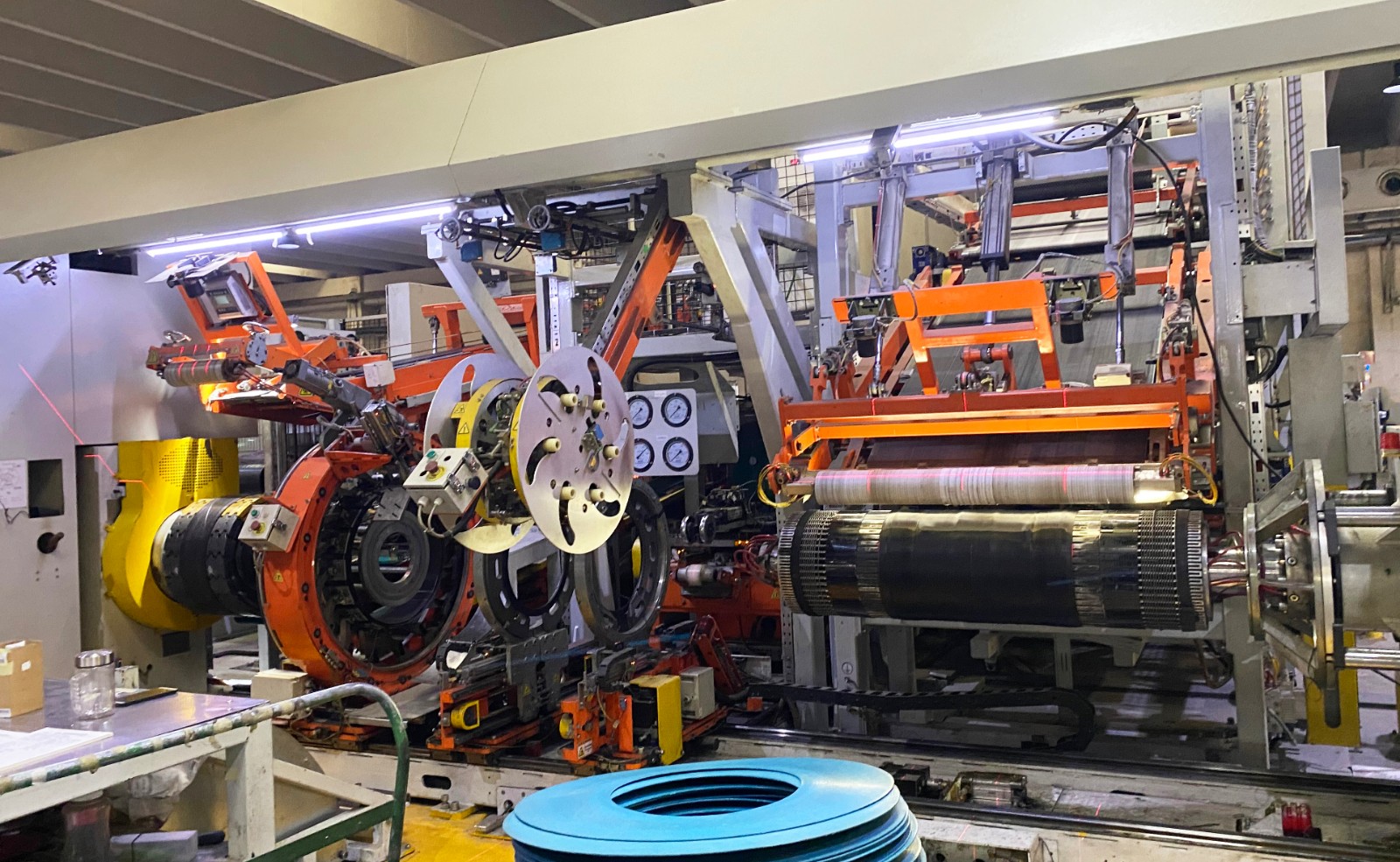

Durable, cost-efficient tyres. Our heavy-truck tyres feature reinforced carcass design, high-strength steel belts, and optimized heat-resistance for high-load long-haul service. While initial cost is slightly above entry-level, the longer life, fewer replacements, better fuel economy reduce cost per km.

Tailored recommendations by duty-cycle. Instead of a one-size model, we assist fleets by matching tyre patterns/structures to their operational profile: long-haul interstate, regional distribution, heavy industrial/mining, urban logistics.

Full lifecycle service support. We provide installation guidance, periodic tyre condition checks, wear/heat analysis, rotation/retread plans, emergency backup tyres. The tyre becomes a managed asset rather than a commodity.

Risk mitigation and reputation enhancement. A higher quality tyre reduces blow-outs and downtime, thereby protecting the fleet’s reputation and reducing insurance/repair cost exposure.

Education and partnership. We equip fleet operations with tools: tyre-selection training, driver tyre-care guidance, cost-per-kilometre calculators. We are not just a supplier—we are a strategic partner.

To ensure success, we recommend fleets follow these steps:

Define operational profile and tyre needs: vehicle class, route type, annual kilometres, load levels, downtime cost, fuel cost.

Demand full-life cost analysis: ask suppliers for data on expected mileage, number of replacements, fuel savings, downtime impact.

Evaluate supplier’s service capability: installation, monitoring, reports, retread capability, emergency support.

Check future readiness: does the supplier offer low-rolling-resistance tyres, smart-tyre monitoring, retread/re-use programs?

Formalise partnership: set performance metrics, service agreements, replacement terms. View tyres as strategic assets, not just consumables.

At a time when new-truck volumes are under pressure and market structure is changing, the heavy-truck tyre industry is shifting from volume growth to value creation. For tyre suppliers, competing on price alone is no longer sufficient; for fleets, choosing the cheapest tyre may increase long-term cost and risk. We are positioned at the crossroads of this transformation—offering tyres that are durable, efficient, supported with services, and aligned to fleet economics. We invite you to partner with us for fewer breakdowns, longer mileage, lower cost—because we understand tyres are not just parts; they are operational enablers.

Copyright © 2024-2025 Firemax Sdn. Bhd Company. All rights reserved.

Headquarters address:303 block C, Pusat Dagangan Phileo Damansara 1, No 9 Jln 16/11 Off Jalan Damansara, 46350 Petaling Jaya, Selangor. Malaysia Sales Hotline:+60 11-6449 0688 After-sales hotline:+60 11-6449 0688